The NBS Head Office Building was built from 1888 – 1890, on the basis of blueprints designed by Konstantin Jovanovic (Vienna 1849 – Zurich 1923), son to distinguished artist Anastas Jovanovic...

The NBS carries out prudential supervision of banks, as off-site supervision – by examining reports and other documentation that the bank submits to the NBS in accordance with the law governing banking operation and other data on the bank’s operation available to the NBS, and as on-site supervision – by inspecting the bank’s business books and other documentation. With a view to preserving and strengthening the stability of the financial system and improving the bank supervision function in accordance with the development and growth of bank's activities and with a view to harmonising domestic regulations with those of the European Union, the NBS continually works on improvement of the regulatory framework and supervisory activities in line with the characteristics of the domestic market and international standards in this area.

The Supervisory Review and Evaluation Process (SREP) that is carried out in the Bank Supervision Department is an ongoing process bringing together findings from all supervisory activities performed on an individual bank into a comprehensive supervisory overview of that bank. In that sense, supervisory activities include establishing an overall score for the bank and, where needed, undertaking supervisory measures by the NBS with a view to removing the identified irregularities in the bank's operation, in accordance with the current regulatory framework. When conducting the assessment the supervisor applies the principle of proportionality in carrying out supervisory activities and structuring the dialogue with banks.

The Bank Supervision Department categorises banks according to their size, structure and internal organisation, as well as according to the nature, scope and complexity of their business activities.

Based on the analysis of internal criteria, the following 4 categories of banks are identified:

The above categorisation of banks is subject to a periodic review and represents the basis for application of the principle of proportionality and not the criterion for assessment of the bank's quality; the principle of proportionality is applied when deciding on the scope, frequency and intensity of supervisory engagement and dialogue with a bank, and in forming supervisory expectations about the standards the bank should meet regarding the SREP element observed, in accordance with the group into which it is categorised according to the given SREP element.

Employees in the Bank Supervision Department regularly monitor basic and additional risk indicators in order to timely identify changes in the financial condition and risk profile of the bank.

Basic risk indicators are used for a quantitative assessment of each element in the overall SREP assessment of the bank. For each of the available basic indicators, the supervisor internally determines the range of indicator values, scores corresponding to those ranges and the weight of each indicator in the overall quantitative assessment of an individual element of the supervisory assessment.

The Bank Supervision Department also monitors other additional risk indicators that are specific for the given bank or the group of similar banks. These indicators may be complemented by macroeconomic indicators, as well as indicators which take into account geographic areas, sectors and branches of industry.

The outcome of the supervisory assessment is the overall SREP assessment which includes setting a score in the range from 1 (the risks identified pose no material risk to the viability of the bank) to 4 (the risks identified pose a high level of risk to the viability of the bank). Where the bank is considered to be failing or likely to fail, the supervisor assigns to the bank the overall SREP score "P".

The overall SREP assessment is based on the following elements:

The supervisor makes the overall SREP assessments of different degrees of granularity depending on the group to which the bank belongs and its size, nature, complexity and riskiness of business activities, and/or its business model.

Based on the findings of the conducted SREP process, the NBS may undertake, in accordance with regulations, appropriate supervisory measures to remove the identified irregularities and to set the capital adequacy ratio higher than the one prescribed.

The focus of the supervisory analysis of the bank's business model is on the assessment of the viability of the bank’s current business model and the sustainability of its strategic plans in the existing economic environment.

The business model analysis takes into account the following elements: ability to generate returns in view of the bank's risk appetite and its funding structure; (lack of) concentration of property/assets or income sources; bank's competitive advantages in the market and how the bank's strategy impacts its competitiveness; assessment of assumptions about the future business environment which the bank used in its financial forecasts; adequacy and/or feasibility of strategic goals.

The weaknesses identified in the business model analysis are used in detection of the bank's key vulnerabilities which will certainly have a significant impact on the bank's operation and its risk profile. In addition, the business model analysis enables early identification of problems which the bank is facing or is likely to face. The results obtained by the business model analysis are taken into account in the assessment of all other SREP elements.

Within the SREP, the Bank Supervision Department analyses corporate governance in the bank, with the special emphasis on the system and functioning of corporate governance, the remit, responsibilities and structure of management bodies, risk management system, system of internal controls and the findings of the conducted assessment of the recovery plan.

The focus of the assessment of corporate governance and the system of internal controls is on assessing their correspondence to the risk profile, business model and size and complexity of the bank's operations, as well as on the extent to which the bank complies with the regulations, prudential business standards and good business practices in the area of corporate governance, risk management and internal controls system.

The Bank Supervision Department assesses a potential material impact of inadequate corporate governance and the internal controls system, particularly the impact on the bank's viability.

The assessment of corporate governance and the internal controls system includes the analysis of the following areas:

Based on the assessment of individual areas of corporate governance and internal controls system, the supervisor assesses whether the weaknesses in corporate governance and the internal controls system at a bank-wide level pose material risks to the bank's viability. Also, the assessment of this segment serves as important information in assessing the management of individual risks, as well as in assessing the adequacy of capital and liquid assets.

Within the SREP, the Bank Supervision Department analyses risks which impact solvency of the bank and which were assessed as material.

The key risks that impact the bank's solvency are the following:

Also, when assessing risks to solvency, the sub-categories within each of the above risk categories need to be taken into account. Depending on the materiality of any of these sub-categories of risk to a particular bank, they should also be assessed and scored individually. The decision on materiality of each of the sub-categories of risk depends on the supervisory judgement.

In addition to the above, the supervisor also assesses other risks that are considered material in case of a particular bank.

For each material risk, the supervisor assesses:

When performing the assessment, the supervisor uses all available information sources, including regular and ad-hoc regulatory reporting, the bank’s internal indicators and reports (e.g. internal audit reports, risk management reports, information from the ICAAP), on-site examination reports and external reports (e.g. the bank’s communications to investors, reports complying with the NBS's regulations and guidelines about the disclosure of data and information by banks).

When assessing risks that affect solvency, the supervisor also assesses the accuracy and reliability of the calculation of minimum own fund requirements to identify situations where additional own funds requirements are needed.

The supervisor determines a score for every material risk primarily based on the assessment of the risk level, but also reflects considerations and findings about risk management and controls, such as the fact that the adequacy of management and controls may increase or – in exceptional cases – reduce the impact of the observed risk on the bank.

In order to produce a comprehensive assessment of the risks to the bank's solvency, the supervisor assesses whether an adequate risk management system has been set up, particularly: a strategy for the management of the given risk and appetite for and/or tolerance toward that risk, organisational structure, policies, procedures and other internal acts, the process of identification, measurement, monitoring and reporting about that risk and the system of internal controls.

Based on the conducted assessment, the supervisor determines a score for each material risk, ranging from 1 (considering the level of a particular risk and the system of management and controls of that risk, the bank is not materially exposed to this risk) to 4 (considering the level of a particular risk and the system of management and controls of that risk, the bank is highly exposed to that risk).

In assessing credit and counterparty risk, the supervisor considers all the elements that determine potential credit losses, and in particular: the probability of default, or relevant credit events, that mainly concern the borrowers and their ability to repay obligations; the size of exposures to credit risk; and the recovery rate of the credit exposures in the event of borrower's defaulting. Through the assessment of the level of credit risk, the supervisor determines the main drivers of the bank’s credit risk exposure. Credit risk assessment includes: assessment of the characteristics and composition of the credit portfolio, assessment of credit portfolio quality, assessment of the amount and quality of credit protection instruments, and assessment of allowances for impairment to balance sheet assets and provisions for losses on off-balance sheet items. The supervisor assesses credit risk in both current and prospective terms. In assessing the types of credit risk, at least the following sub-categories of credit risk are considered: credit concentration risk, counterparty credit risk and settlement risk, country risk, credit risk from securitisations, FX lending risk; and specialised lending risk.

The supervisor assesses market risk which arises from all exposures in the trading book, as a minumum, the following sub-categories of market risk: position risk, foreign-exchange risk, commodities risk and credit valuation adjustment risk. The assessment of market risk concerns those on- and off-balance-sheet positions subject to losses arising from movements in market prices and includes: assessment of the nature and composition of the bank’s positions subject to market risk, assessment of profitability, assessment of market concentration risk and assessment of the outcome of stress testing.

In view of the fact that operational risk is inherent to all banking products, activities, processes and systems, the supervisor takes into account all findings from the assessment of corporate governance and the system of internal controls. The supervisory assessment of the level of operational risk determines how operational risk may materialise and also considers potential impacts in terms of other risks (e.g. credit-operational risk, market-operational risk ‘boundary cases’). The supervisor additionally assesses the materiality of operational risk arising from outsourced activities, and whether these could affect the bank’s ability to process transactions and/or provide services, or cause legal liabilities for damage to third parties (e.g. customers and other persons). When assessing operational risk, competent authorities should also consider: reputational risk, risk of money laundering and terrorism financing, legal risk, conduct risk, information system risk and model risk. When assessing the risk of money laundering and terrorism financing, the supervisor takes into account the main sources of bank's exposure to this risk, namely: business network size, structure of client base, products and services, executed transactions, outsourcing of customer due diligence actions and measures to other persons and correspondent relations.

When assessing interest rate risk, the supervisor identifies the main sources of exposure to interest rate risk and assesses potential impact of this risk to the bank from the standpoint of its income statement and bank's economic value. When assessing the level of interest rate risk, the supervisor takes into account the following forms of interest rate risk: repricing risk, yield curve risk, basis risk and optionality risk. The supervisory assessment includes: assessment of the nature and structure of the interest rate risk profile and results of the stress testing.

The SREP includes the analysis of risks to liquidity. The main risks impacting liquidity are market liquidity risk and funding risk.

The assessment of the main risks which impact liquidity is conducted in three steps:

When assessing the market liquidity risk and funding risk, the supervisor verifies the bank’s compliance with minimum regulatory requirements.

In order to produce a comprehensive assessment of the market liquidity risk and funding risk, the supervisor assesses whether an adequate risk management system has been set up, particularly: the liquidity risk management strategy and appetite for and/or tolerance to liquidity risk, organisational structure, policies, procedures and other internal acts, the process of identification, measurement and reporting on liquidity risk, stress testing of liquidity risk conducted by the bank, the system of internal controls and contingency plan.

Based on the conducted assessment, the supervisor determines a score, ranging from 1 (considering the level of the market liquidity risk/funding risk and the system of management and controls pertaining to that risk, there is no material risk to the bank) to 4 (considering the level of market liquidity risk/funding risk and the system of management and controls pertaining to that risk, the bank is highly exposed to that risk).

In the process of supervisory assessment of capital adequacy, the Bank Supervision Department determines whether the own funds held by the bank provide sound coverage of risks to which the bank is or might be exposed, if such risks are assessed as material to the bank including the adequacy of calculation of own funds requirements and available own funds of the bank. A comprehensive review of this process by the supervisor is conducted, among other, through a dialogue with the bank.

As a result of this assessment, the supervisor determines the amount (quantity) and structure (quality) of additional own funds necessary for the coverage of individual elements of risks set out by the decision governing capital adequacy of banks and risks that are not set out in the decision, and/or for the coverage of additional own funds requirements.

Supervisory assessment of the bank's own funds assumes bank's business continuity, i.e. it is applied according to the going concern principle (as opposed to resolution plans that are developed according to gone concern principle).

After considering the results of the risk assessment, the following steps are taken within the supervisory assessment of own funds: determination of the additional own funds requirements, reconciliation of additional own funds requirements with capital buffers and any macro-prudential requirements, determination and articulation of the total SREP capital requirement and overall capital requirement;

Total SREP capital requirement (TSCR) means the sum of own funds requirements for coverage of all risks the bank is or may be exposed to in its operation, determined based on the supervisory assessment.

Overall capital requirement – OCR means the sum of the total SREP capital requirement (TSCR), capital buffer requirements and macro-prudential requirements, when expressed as own funds requirements.

The supervisor determines additional own funds requirements for covering the risk of unexpected losses, and of expected losses insufficiently covered by allowances for impairment and provisions, over a 12-month period, the risk of underestimation of risk due to model deficiencies (in the context of the decision governing capital adequacy) and the risk arising from deficiencies in corporate governance, including internal controls, processes and other deficiencies.

Additional own funds requirements for covering unexpected losses are determined by using:

If, during the ongoing review of application of internal models for calculation of own funds requirements in accordance with the decision governing capital adequacy, the supervisor identifies model deficiencies that could lead to underestimation of the minimum own funds requirements set out by this Decision, the supervisor shall set additional own funds requirements to cover the risk posed by model deficiencies that could lead to underestimation of risk where this is determined to be more appropriate than other supervisory measures. The supervisor shall set additional own funds requirements to cover this risk only as an interim measure while the deficiencies are addressed.

The supervisor shall set additional own funds requirements to cover the risks posed by internal controls, governance or other deficiencies identified following the risk assessment – where this is considered more appropriate than other supervisory measures. The supervisor shall set additional own funds requirements to cover these risks only as an interim measure while the deficiencies are addressed.

The supervisor shall set additional own funds requirements to cover the funding risk – identified following the risk assessment – where this is determined to be more appropriate than other supervisory measures.

The supervisor verifies the accuracy of ICAAP calculations and corrects own funds requirements, i.e. the available own funds, if it determines that the bank has not calculated them correctly, and/or has under- or overestimated them. In that sense, it is not allowed that minimum own funds requirements calculated in accordance with the decision governing capital adequacy serve as a coverage for additional own funds requirements, both on the basis of overall and individual risk exposures.

The supervisor verifies the reliability of the ICAAP calculation by assessing whether, from the standpoint of risk management, this calculation represents the link between bank's business decisions, risk management strategy and own funds planning, as well as whether it is:

The supervisor conducts a detailed assessment of the reliability of the ICAAP calculations by comparing them against the outcome of the supervisory benchmarks for the same risks, and other relevant inputs.

If reliable or reliable to a significant degree, the bank's ICAAP calculation serves as a basis for the supervisory assessment of additional own funds requirements, and is supplemented by outcomes of supervisory benchmarks and other relevant data. Where ICAAP calculation is not considered reliable, supervisory benchmarks serve as a basis for determining additional own funds requirements, supplemented by other relevant data.

Total SREP capital requirement (TSCR) is determined as a sum of:

The supervisor sets a composition requirement for the additional own funds requirements of at least 56% Common Equity Tier 1 (CET1) and at least 75% Tier 1 (T1) to cover the following risk types:

The supervisor determines the composition of additional own funds requirements to cover other risk types that are not mentioned above, including the risks arising from deficiencies in corporate governance and internal controls system and other deficiencies, taking into account the level and nature of the risk in question.

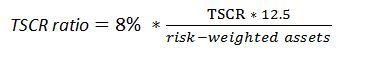

When assessing/calculating TSCR ratio (increased adequacy ratio) of a bank, the supervisor takes into account only elements which can be included in calculation of specific forms of the bank's own funds, in accordance with the decision governing capital adequacy of banks, where such calculation starts from the following formula:

OCR ratio for a bank is calculated by adding capital buffer requirements and other macro-prudential requirements to the calculated TSCR ratio.

The supervisor assesses whether the submitted capital management plan is realistic from the standpoint of the bank's ability to respond to TSCR or OCR over the assumed time period.

In analysing the bank's capital management plan, the supervisor assesses the adequacy of activities which the bank laid out in the plan, such as whether legal and reputation limitations to the implementation of those activities have been taken into account and whether the plan is aligned with the business policy and strategy, as well as the appetite for and/or tolerance to risk. Taking into account the outcomes of the bank's stress tests (that are assessed as reliable) or the supervisory stress tests, the supervisor assesses whether the bank might fail to meet TSCR or OCR ratios in the coming period.

Based on the conducted analysis, the supervisor determines capital adequacy score within SREP, in the range from 1 (the quantity and composition of own funds held pose no material risk to the bank's viability) to 4 (the quantity and composition of own funds held pose a high risk to the bank's viability).

The Bank Supervision Department determines, in the supervisory assessment of adequacy of liquid assets, whether the bank's liquid assets are adequate for the coverage of market liquidity risk and funding risk.

After reviewing the results of the above described liquidity risk assessment, the supervisor takes the following steps as part of the supervisory assessment of liquid assets:

To assess whether the bank's liquid assets provide appropriate coverage of market liquidity risk and funding risk, the supervisor uses the following sources of information:

Where it deems necessary, from the standpoint of the market liquidity risk and funding risk, the supervisor may take special quantitative and/or qualitative measures relating to liquidity, depending on the sources of risk and its potential impacts on the bank's operation.

Based on the conducted analysis, the supervisor determines a score ranging from 1 (the bank's liquidity position and funding profile pose no material risk to its viability) to 4 (the bank's liquidity position and/or funding profile pose a high risk to its viability).